Top Tips for Crisis Recovery

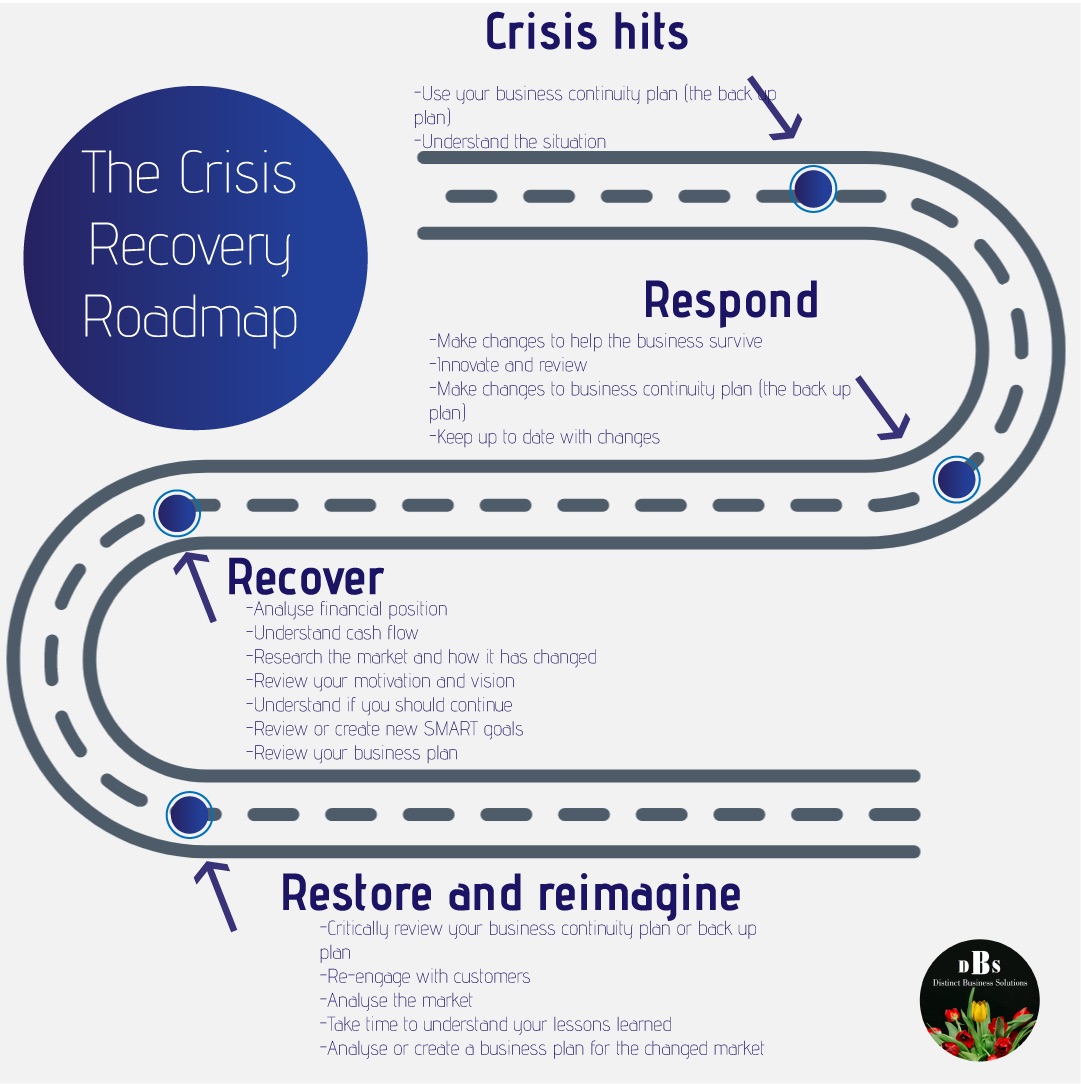

The effects of a crisis on a business can be disastrous, overwhelming and difficult to navigate. It can be hard to know where to turn, what to do next and how to plan a path to recovery. We’ve put together an easy to follow list of tips to help you navigate crisis recovery and move towards a brighter future.

-

Analyse your financial position

Crisis can have a significant impact on finances. To understand you financial postion you need to analyse your finances in great detail.

-

Understand cash flow

To recover from a crisis you need to understand your cash flow. Budgeting and mapping out your cash flow will ensure you are certain you can meet your liabilities and make you payments.

-

Research your market

Crisis can change the market you operate in. To recover it is important that you research your market including changes to customer’s financial position and routine. You should understand where you will find your customer and their willingness to pay for goods and services.

-

Review your motivation and vision

Recovery is the perfect time to review your motivation and vision. What do YOU want your business and clients to look like moving forward? How can you create the business that fulfils you?

-

Review your strategy

A great way to recover is review your strategy or to create a brand new strategy. This strategy will help you to focus on the income streams or vision and how you can move forward.

-

Analyse your financial data from before, during and after the crisis

Analysing your financial data from throughout the crisis can help you to learn about your business. Your accountant may be able to provide independent and reputable data about your industry or market to help you compare and understand what your financial data means.

-

Understand IF you should continue

For some businesses recovery isn’t ideal. If you aren’t sure if recovery is right for your business you can learn more on our blog “To close or continue in business”.

-

Review or create new SMART goals

Crisis can serve as a reminder of what is important to you or your business. They also often change the market and what is a realistic goal meaning recovery is the perfect time review or create new SMART goals. It is important to keep goals realistic in recovery for example if the economy is in a recession, stability rather than extreme growth might be realistic.

-

Review your business plan

We cannot stress the importance of a business plan highly enough. Completing a thorough SWOT analysis, setting goals and creating a roadmap to achieve goals are key to business recovery and ultimately success.

-

Consider alternatives

In recovery it is important to consider alternatives- should you:

a) Continue as you have been

b) Change your business model

c) Change your target market

11. Review your learnings

Crisis can be a wonderful tool for learning. The recovery phase is the perfect opportunity to learn from a crisis. Can you save money by staying online only? Do your customers prefer a hand written note? Should you keep your meetings online to help clients feel connected to you?

-

Document your assumptions

Assumptions, we all have them in, business recovery it is important that you write down and understand your assumptions in your business plan. Writing assumptions down can be helpful to moving forward and disproving unhelpful or untrue assumptions. Remember your past experiences may not be relevant to the changed world post crisis.

-

Understand the impact of diverted payments

During a crisis it is tempting or vital to survival to divert payments. In recovery it is important to understand the impact of these diverted payments. Budgeting, understanding cash flow and the impact of any interest will help you to recover and be successful.

-

Take time to review the cost of reopening

In recovery it is important to review your costs more than ever. Understanding the variation between budget and actual expenditure will help you to learn and grow. It is also an opportunity to review any changes that could save you money throughout the recovery process.

Recovering from a crisis can be a stressful and daunting time. But with some good analysis, sound decision making and planning your business could end up better than ever. Feeling overwhelmed? A qualified accountant or business coach can help guide you through the recovery process with important insights and expertise. If you need a hand with part or all of the recovery process, give us a call today 0411 876 912.

Any advice in this blog is general in nature and is intended for information purposes only. For personalised advice please contact your accountant.

Innovation in a Pandemic

Innovation in a Pandemic The [...]

10 Things You CAN do in COVID-19

10 Things You CAN do in COVID-19 [...]